Live Makkah

Live Madinah

Urdu Font Download

Latest News:

Padubidri: Fishing boat capsizes; all 7 fishermen on board rescued Alleged atrocity on lawyer: Punjalakatte SI suspended Moral policing at jewellery shop: 4 arrested Bajrang Dal activists try to assault youth, girlfriend in Mangaluru SC to hear Bilkis Bano’s plea against release of 11 convicts on 13 Dec Nusrat Noor: First Muslim Woman to Top Jharkhand Public Service Commission

Latest News:

Padubidri: Fishing boat capsizes; all 7 fishermen on board rescued Alleged atrocity on lawyer: Punjalakatte SI suspended Moral policing at jewellery shop: 4 arrested Bajrang Dal activists try to assault youth, girlfriend in Mangaluru SC to hear Bilkis Bano’s plea against release of 11 convicts on 13 Dec Nusrat Noor: First Muslim Woman to Top Jharkhand Public Service Commission

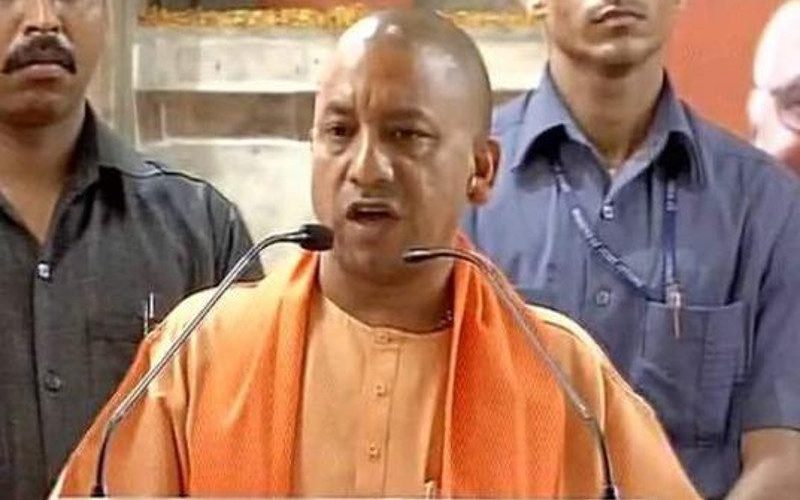

Yogi Adityanath on Ayodhya: Justice delayed is justice denied, other options too

New Delhi, 31 oct 2018 [Fik/News Sources]: Amidst the widening rift between Modi government and India's central bank, media reports claimed that Urjit Patel is considering to resign as Reserve Bank of India (RBI). Reports claimed that Patel may tender his resignation by today evening.

“The RBI governor may consider resigning. All options on the table", RBI sources told CNBC-TV18.

Another official while speaking to MyNation.com said that Patel would relinquish his post as the head of the top custodian of the country’s banks on his own volition.

The term of office typically runs for 3 years. Urjit Patel completed two years as RBI Governor on September 03, 2018.

Urjit Patel was elevated from deputy governor's position to the post of RBI Governor when Raghuram Rajan exited the RBI governor’s office in September 2016.

Urjit Patel was considered as the Modi government's blue-eyed boy. The belief was validated in November 2016 when the demonetisation was announced and the RBI under him endorsed the controversial move, reportedly opposed very strongly by Rajan.

The reports of Urjit Patel's resignation surfaced amidst the rift between RBI and the government over various issues.

The rift between the two started after the government demanded that RBI eases its lending restrictions on banks that have a low capital base and a massive rise in bad debts. Another contentious issue is the control over interest rates. While the RBI wants sole authority over raising or lowering the interest rates, the government is unhappy over its decisions.

The unprecedented differences between the Modi government and RBI hit media headlines when Reserve Bank of India (RBI) Deputy Governor Viral Acharya on Friday warned that undermining the central bank’s independence could be “potentially catastrophic”, in an indication that it is pushing back hard against government pressure to relax its policies and reduce its powers.

In a speech to top industrialists Acharya cited the Argentine government’s meddling in its central bank’s affairs in 2010 as an example of what can go wrong. That led to a surge in bond yields that badly hurt the South American economy.

“Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution,” Acharya said.

Adding to the row, Finance Minister Arun Jaitley on Tuesday blamed the RBI for failing to stop a lending spree during 2008-2014 that left banks with $150 billion of bad debt.

Responding to the reports of Urjit Patel's resignation, a senior trader at a foreign bank told Reuters, "It is difficult to believe that the RBI governor will resign because it is unprecedented and would look quite irresponsible and (an) immature step."

“But it is quite worrisome to see the government trying to continuously interfere into the RBI’s operations", he added.

Prayer Timings

| Fajr | فجر | |

| Dhuhr | الظهر | |

| Asr | أسر | |

| Maghrib | مغرب | |

| Isha | عشا |